Broward County Luxury Condo Sales Drop 3rd Straight Summer Season From 2021 Peak

A review of the Broward County luxury condo sales statistics shows that prices were down more than four percent on a year-over-year basis in the 2024 Summer Buying Season.

Note: A series of charts are available behind the paywall to members of the Miami Condo Investing Club™. Click here to join the Club.

Broward County luxury condo transactions fell this year for the third consecutive Summer Buying Season since peaking in the 2021 season, according to an analysis of statistics compiled by CondoVulturesRealty.com.

As for pricing, the change in the average price per square foot for luxury condo units flatlined, dropping nearly one percent during the 2024 Summer Buying Season.

The Summer Buying Season traditionally extends from May through October when visitors and locals, alike, flee South Florida to avoid the humidity, hurricane warnings and limited number of events.

For this report, luxury condos are defined as those units that are listed and sold for a minimum price of $1 million each.

Buyers purchased about 178 luxury condos in Broward County in the 2024 Summer Buying Season.

By comparison, buyers purchased about 190 luxury condos a year earlier in the 2023 season.

This summer’s slowdown represents more than a six percent decrease in Broward County luxury condo transactions on a year-over-year basis.

Luxury condo sales were already on a downward trend before this summer, falling by nearly 32 percent in the 2023 season compared to the 2022 season when more than 280 units traded.

The 2022 season was down by more than seven percent from a year earlier.

During the 2021 season, more than 300 Broward County luxury condos traded in a six-month span as stay-at-home orders from the pandemic were lifted and a plethora of work-from-home employees relocated to South Florida from places such as California, Illinois and New York.

Looking back at the statistics, the 2021 season represents the peak of luxury condo sales during a Broward County Summer Buying Season since at least 2007.

Industry watchers are at odds as to the direction of the Broward County housing market in 2025.

Bullish investors are predicting housing demand will reignite now that the Federal Reserve has begun to cut interest rates.

Bearish investors contend that home prices are too high and likely to collapse in the months ahead.

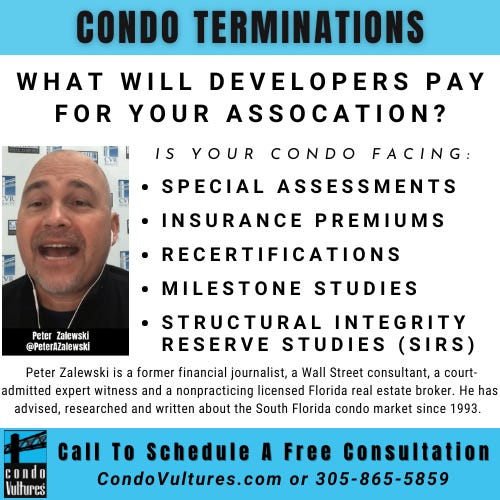

Added to this, Florida unit owners are increasingly experiencing the headwinds - spiking special assessments and falling prices from sellers trying to unload their properties - from the looming 2025 condo association financial cliff.

In the aftermath of the June 24, 2021, collapse of the Champlain Towers South in the town of Surfside on the barrier island of Broward County, everyone from residents to building inspectors, politicians to bankers understand better than ever the importance of ensuring that no Florida condo building ever collapses again.

Nearly 100 people died and a $1 billion settlement was reached with the families of the victims.

A federal investigation is currently underway but the preliminary reports suggest a flawed design coupled with a lack of upkeep by the condominium’s association contributed to the disaster.

The Florida Legislature has taken a number of steps - prompted by insurance companies threatening to withdraw coverage in the state - to ensure that nothing like this ever happens again.

Up until now, the state’s measures were being implemented slowly but that all changes in less than 45 days when a key funding requirement takes effect.

Beginning in January, condo associations in Florida will be required to start collecting money from unit owners to place into reserve accounts - based on the results of Structural Integrity Reserve Studies (SIRS) conducted by experts - that will be used exclusively to fix, maintain and improve the structural integrity of residential buildings that are at least three-stories tall.

People are dubbing this moment as the 2025 Florida Condo Association Financial Cliff as it is expected to result in significantly higher costs for unit owners. News reports are already chronicling condo owners selling their units at deep discounts ahead of the 2025 deadline.