Did South Florida's Condo Market Just Experience A Black Swan Event?

In this latest issue of the Miami Condo Market Intelligence Report™, we examine whether two key events this week may together impact the South Florida condo market for years to come.

Volume 2024, Issue 35 (Subscribe here)

This week’s Miami Condo Market Intelligence Report™ newsletter examines whether the last full week of September will ultimately be viewed as an inflection point for the South Florida condo market.

Time will tell if we just experienced a pair of actions that together constitute a Black Swan event, which is defined as “an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences,” according to Investopedia.

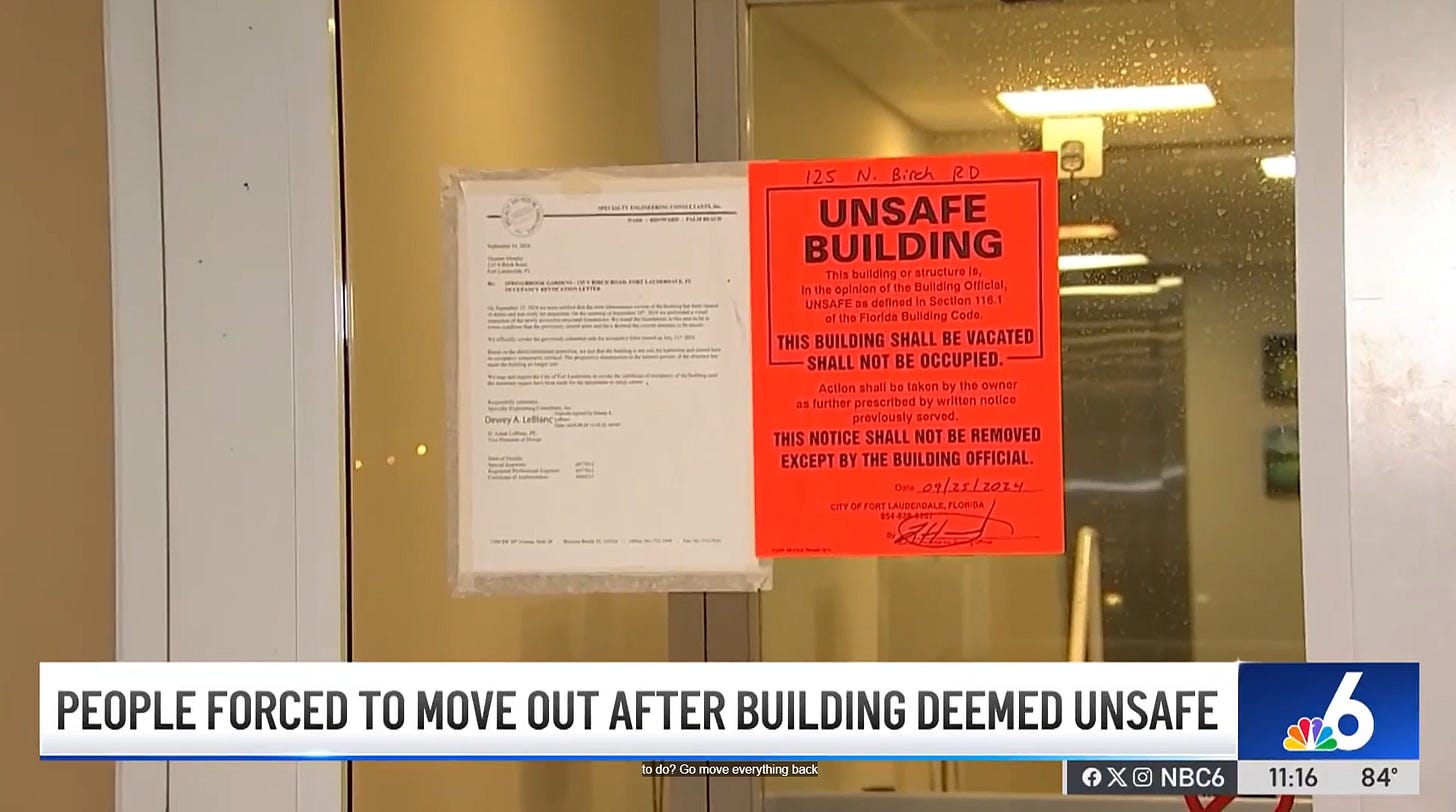

Not only did Category 4 Hurricane Helene cause an estimated $15 billion to $26 billion in damage - with a significant portion of the destruction in Florida - this week but a waterfront condo project called the Springbrook Gardens was declared “unsafe” in Fort Lauderdale Beach.

The request to evacuate the 18-unit condo project on the Broward County barrier island reportedly came from the engineer who was overseeing the association’s concrete restoration work. Apparently, the decision was made after the engineering firm discovered far more structural issues than were originally identified.

Taken individually, the two events seem unrelated at first glance although they are likely to exacerbate Florida's already soaring insurance costs and intensify scrutiny of the structural integrity of condo building.

Taken together, however, the combined impact of these events grows when considered in tandem, particularly given their timing - just a week or so after the Federal Reserve cut interest rates in hopes of achieving a “soft landing” and avoiding a slowdown in the U.S. economy.

The convergence of these three events in September is raising the anxiety levels of condo owners given that Florida is about 90 days away from the 2025 implementation of a series of new measures to promote safety in the state’s nearly 28,250 condo associations with more than 1.2-million units.

In South Florida, there are nearly 13,000 condo associations with about 610,000 units, according to a recent report.

In the aftermath of the June 24, 2021 collapse of the Champlain Towers South in the town of Surfside on the barrier island of Miami-Dade County, everyone from residents to building inspectors, politicians to bankers understand better than ever the importance of ensuring that no Florida condo building ever collapses again.

Nearly 100 people died and a $1 billion settlement was reached with the families of the victims.

A federal investigation is currently underway but the preliminary reports suggest a flawed design coupled with a lack of upkeep by the condominium’s association contributed to the disaster.

The Florida Legislature has taken a number of steps - prompted by insurance companies threatening to withdraw coverage in the state - to ensure that nothing like this ever happens again.

Up until now, the state’s measures were being implemented slowly but that all changes in 2025 when many of the measures take effect.

Beginning in January, condo associations in Florida will be required to start collecting money from unit owners to place into reserve accounts that will be used exclusively to fix, maintain and improve the structural integrity of residential buildings that are at least three-stories tall.

People are dubbing this moment as the 2025 Florida Condo Association Financial Cliff as it is expected to result in significantly higher costs for unit owners. News reports are already chronicling condo owners selling their units at deep discounts ahead of the 2025 deadline.

Hurricane Helene may turn out to do to the current South Florida condo market exactly what Hurricane Wilma did to the market some two decades ago.

Back in October 2005, Hurricane Wilma - a Category 5 storm at its peak - cut across the southern portion of the state, traveling northeast from Collier County to Palm Beach County.

The fast-moving storm - which caused a significant storm surge and knocked out electricity for more than 3.2 million households in Florida - caused nearly $30 billion in damage overall, according to Wikipedia.

Some $6 billion of the overall destruction was realized in the tricounty South Florida region of Miami-Dade, Broward and Palm Beach alone.

It wasn’t the damage, though, that made it such a memorable storm for the South Florida condo market.

Hurricane Wilma paused the go-go condo market of the early 2000s for a brief moment, altering the trajectory of the market in the tricounty region of Miami-Dade, Broward and Palm Beach.

At the time, condo resales, conversions and new development were being fueled by investors, speculators and fraudsters who descended on South Florida to take advantage of the growing population, readily available credit and generous underwriting.

The storm, however, shut down the insurance market for residential sales in Florida for a brief moment.

Although the condo market showed signs of regaining the momentum in 2006, it was never quite the same during that particular South Florida real estate cycle.

The South Florida market would ultimately be stuck in neutral until the failure of the investment bank Lehman Brothers in September 2008 - marking the symbolic start of the Great Recession - triggered a massive selloff in condos at deeply discounted prices.

Fast forward to today, South Florida condo resale activity has already begun to pull back to levels not seen since 2008, according to a report published in May 2024.

The report found that about 13,733 South Florida condo units traded in the 2023-24 Winter Buying Season that stretched from November 2023 to April 2024. This was the fewest number of condo sales since the 2008-09 Winter Buying Season when about 9,940 units traded.

As we enter the fourth quarter of 2024, the unanswered question going forward is whether buyers will have an appetite for South Florida condos in the upcoming Winter Buying Season given the trio of events that occurred in September.

Industry watchers are at odds as to the direction of the South Florida housing market in the months ahead.

Bullish investors are predicting condo demand will reignite now that interest rates have begun to fall.

Bearish investors contend that condo prices are too high and likely to collapse given Florida’s 2025 Condo Association Financial Cliff.

It is a lot of information but we are confident our reports will assist you to better understand current market conditions in South Florida.

It is worth noting that we are sharing a portion of our research for free with subscribers to our newsletter and readers of CondoVultures.com.

If you want access to all of our published information and charts, we would encourage you to join the newly launched Miami Condo Market Investing Club™.

The objective of the Club is to create a community that shares realtime, actionable information on the latest real estate trends, opportunities and service providers in South Florida.

The Club is ideally suited for Do-It-Yourself (DIY) condo buyers who can rely on our latest statistics, expert opinions and access to consulting services.

Additionally, we encourage you to listen or view our podcast wherever you get podcasts. The podcast is available on Apple, Spotify and/or YouTube.

As a reminder, we are always available for consulting, expert witness work and buyside brokerage services just as we have been since 2006.

If you are seeking information on condo resales in South Florida, please visit CondoVulturesRealty.com or call the office at 305.865.5859.

— Peter Zalewski, Founder of the Miami Condo Market Investing Club™

Story 1

Waterfront Condo Project Declared "Unsafe" In Fort Lauderdale Beach

A red-tag notice posted at the entrance of the Springbrook Gardens condo declared: "THIS BUILDING SHALL BE VACATED."

Story 2

Learn To Evaluate Florida Condo Associations Like A Pro At October Meeting

The 75-minute meeting on Wednesday, Oct. 9, 2024, will feature condo expert Peter Zalewski of the Miami Condo Market Investing Club™.

This information is believed to be accurate and complete but cannot be guaranteed or warranted.

Copyright © 2024 Condo Vultures®, LLC. All Rights Reserved.