Condo Capitalism™ is the weekly podcast hosted by Peter Zalewski of the Miami Condo Investing Club™ that provides data-driven analysis on distressed real estate—foreclosures, shortsales and bank-owned REOs—in the tricounty South Florida region of Miami-Dade, Broward and Palm Beach.

The program dissects players and trends, focusing on the escalating Florida Condo Association Financial Cliff, which is now fully underway as cash-strapped unit owners face rising maintenance fees, hefty special assessments and pricey insurance.

On the show, experts analyze how the national “two-sided risk”—rising inflation and falling employment—magnifies the growing crisis in Florida, revealing where high post-Surfside condo fees clash with a softening resale market to expose the potential for a capitulation by unit owners who can no longer afford condo living.

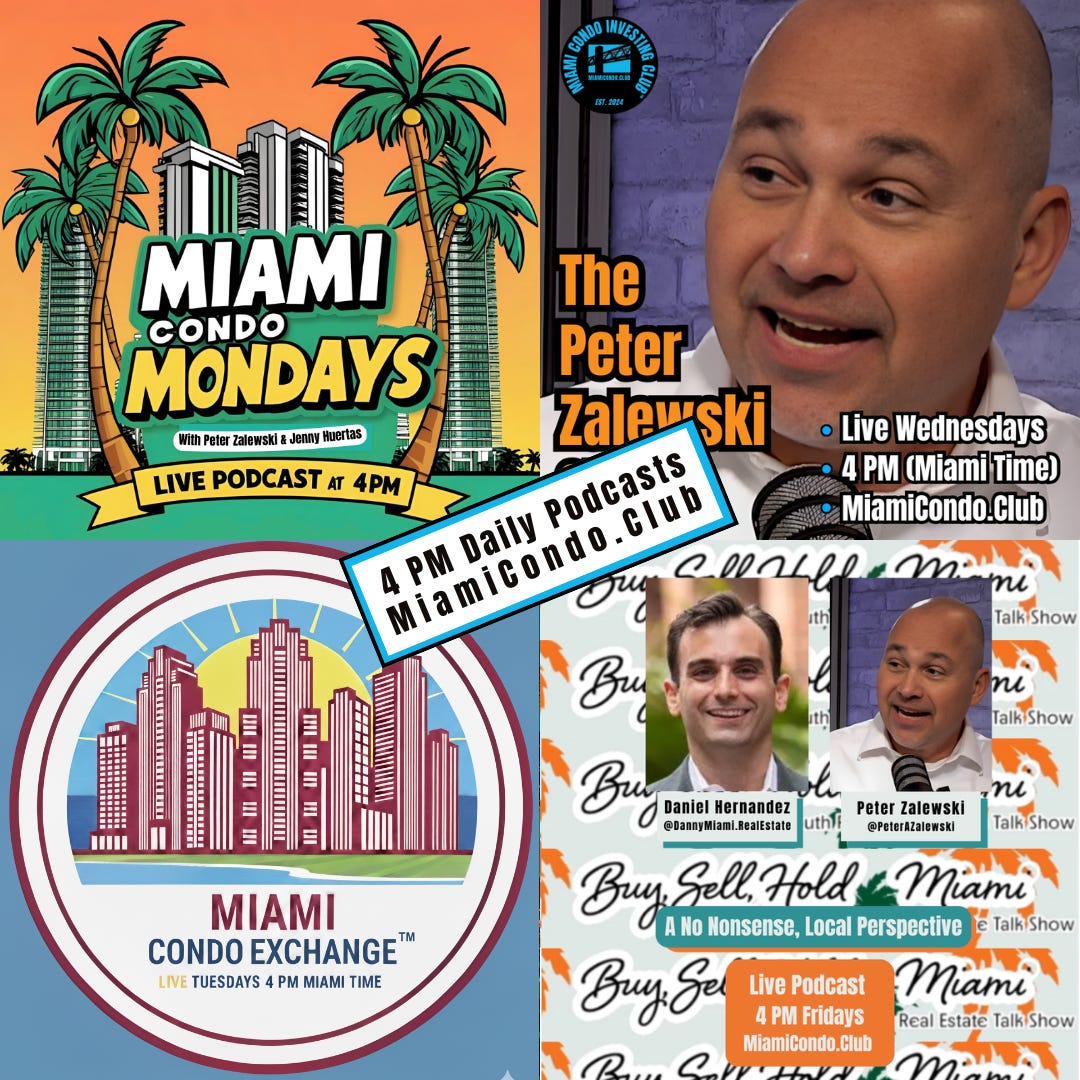

Join Peter Zalewski live every weekday at 4 pm (Miami time) on MiamiCondo.Club for the full schedule: Miami Condo Mondays™ (market overview), Miami Condo Exchange™ (data discussion) on Tuesdays, The Peter Zalewski Show™ (interview) on Wednesdays, Condo Capitalism™ (distressed market) on Thursdays, and Buy, Sell, Hold Miami™ (debate) on Fridays. On-demand recordings of all shows are available here.

Episode Overview

In the Nov. 13, 2025, episode of Condo Capitalism - A Miami Distressed Real Estate Market Podcast, host Peter Zalewski interviews David Dweck, a veteran investor, private money lender and the founder of the Boca Real Estate Investment Club (BRIC) at the start of the 2025-26 Winter Buying Season.

The veteran investor, who has lent out more than $1 billion for residential real estate transactions, wasted no time establishing the core lesson of his more than 30-year career: to be successful in South Florida’s volatile real estate market, buyers must put unwavering fundamentals ahead of emotional impulses if they want to be successful for the duration of their careers.

The 73-minute discussion, which covered everything from private lending practices to the looming threat of the Florida Condo Association Financial Cliff, repeatedly returned to the need for quantitative discipline to survive cycles of appreciation and decline.

The core of Dweck’s philosophy rests on two simple, non-negotiable rules for acquisitions: the “1% Rule” and a minimum capitalization rate—or cap rate—of 10 percent.

The 1% Rule dictates that a property’s monthly gross rent must equal at least one percent of the property’s total purchase price. For example, a $100,000 condo should generate rent of at least $1,000 per month.

For the cap rate, investors first calculate the Net Operating Income (NOI)—the gross annual rental income minus all annual operating expenses, but excluding any debt service.

This resulting NOI is then divided by the property’s purchase price to produce the capitalization rate, which represents the property’s unleveraged rate of return.

The discipline behind this rule is supported by the current distress signals in the market, particularly within the bank-owned real estate (REO) sector.

Live data analyzed during the broadcast showed that Vintage REO condos—those at least 30 years that require Milestone Inspections—are currently trading at a median price of just $215,000 per unit in South Florida.