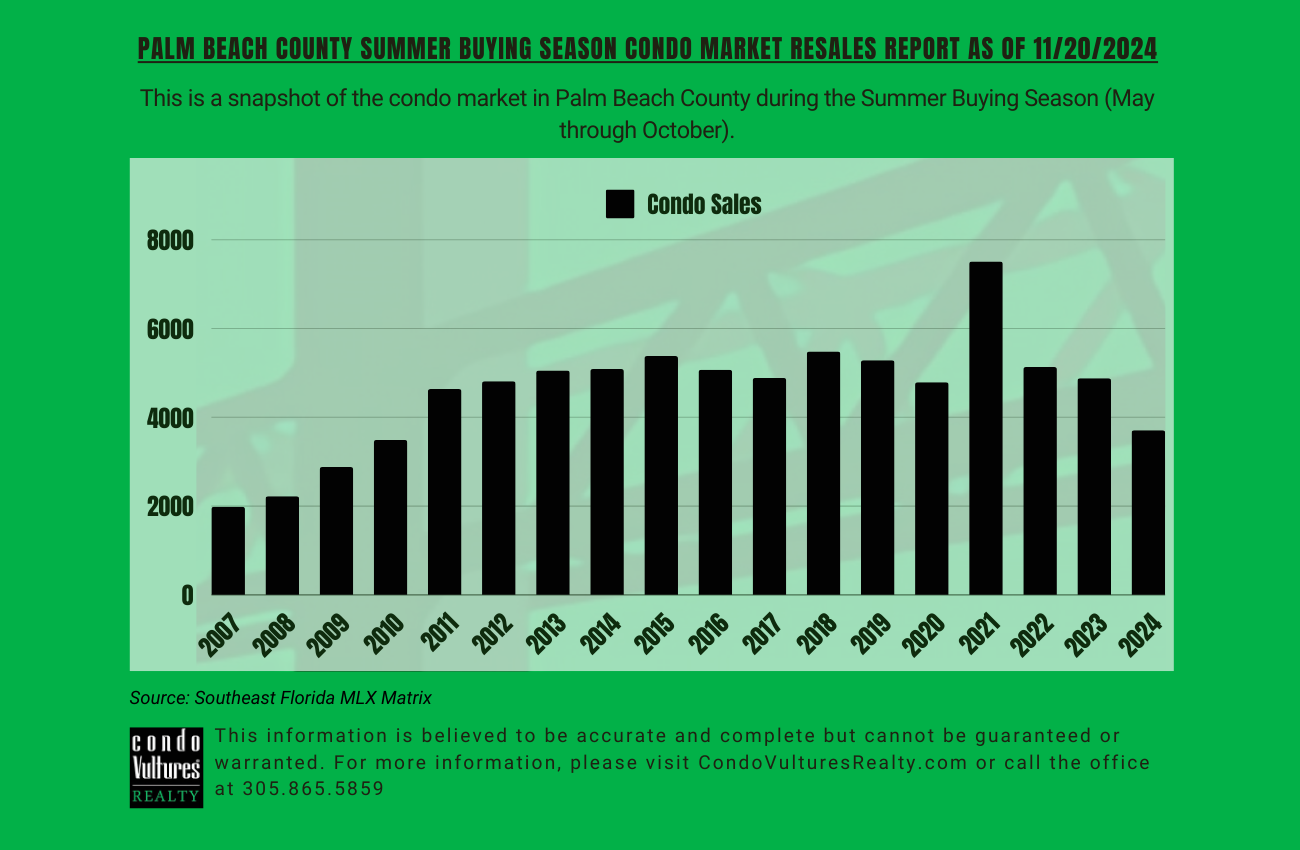

Palm Beach County Condo Sales Crater 24% In 2024 Summer Buying Season

A review of the Palm Beach County condo statistics shows that less than 3,710 units traded between May and October of 2024. This is the fewest number of condo sales since the 2010 season.

Note: A series of charts are available behind the paywall to members of the Miami Condo Investing Club™. Click here to join the Club.

This was the worst Summer Buying Season for condo resales in Palm Beach County since the Great Recession year of 2010, according to an analysis of statistics compiled by CondoVulturesRealty.com.

The Summer Buying Season traditionally extends from May through October when visitors and locals, alike, flee South Florida to avoid the humidity, hurricane warnings and limited number of events.

Even when factoring in the fewer number of tourists that typically visit South Florida during this time of year, this Summer Buying Season was dramatically slower for condo transactions compared to previous seasons.

Buyers purchased about 3,707 condos in Palm Beach County between May and October 2024. By comparison, buyers bought more than 4,880 condos in the 2023 season. That is more than a 24-percent drop in total transactions on a year-over-year basis.

This is the third consecutive year that condo resales were down from the recent peak of the 2021 Summer Buying Season when nearly 7,515 units traded.

It is worth noting, the last time so few condos traded during a Palm Beach County Summer Buying Season was the 2010 season when less than 3,500 units transacted.

Many industry watchers consider the September 2008 bankruptcy filing of the former Wall Street investment bank Lehman Brothers as the “climax of the subprime mortgage crisis” and the resulting Great Recession, according to Wikipedia.

For context, less than 2,220 condos transacted during the 2008 Palm Beach County Summer Buying Season. A year later in the 2009 season, more than 2,880 units traded as prices were slashed.

This is an about-face from the pandemic years when a plethora of work-from-home employees relocated to South Florida from places such as California, Illinois and New York.

The influx of transplants to South Florida bought up or leased out much of the available housing supply, which increased prices and triggered new development.

Rising property values from strong demand, skyrocketing insurance prices following the Surfside condo collapse disaster and high interest rates from a series of hikes by the Federal Reserve brought the South Florida housing market to a standstill in the second half of 2023.

Added to this, Florida unit owners are increasingly experiencing the headwinds - spiking special assessments and falling prices from sellers trying to unload their properties - from the looming 2025 condo association financial cliff.

In the aftermath of the June 24, 2021, collapse of the Champlain Towers South in the town of Surfside on the barrier island of Palm Beach County, everyone from residents to building inspectors, politicians to bankers understand better than ever the importance of ensuring that no Florida condo building ever collapses again.

Nearly 100 people died and a $1 billion settlement was reached with the families of the victims.

A federal investigation is currently underway but the preliminary reports suggest a flawed design coupled with a lack of upkeep by the condominium’s association contributed to the disaster.

The Florida Legislature has taken a number of steps - prompted by insurance companies threatening to withdraw coverage in the state - to ensure that nothing like this ever happens again.

Up until now, the state’s measures were being implemented slowly but that all changes in about 30 when a key funding requirement takes effect.

Beginning in January, condo associations in Florida will be required to start collecting money from unit owners to place into reserve accounts - based on the results of Structural Integrity Reserve Studies (SIRS) conducted by experts - that will be used exclusively to fix, maintain and improve the structural integrity of residential buildings that are at least three-stories tall.

People are dubbing this moment as the 2025 Florida Condo Association Financial Cliff as it is expected to result in significantly higher costs for unit owners. News reports are already chronicling condo owners selling their units at deep discounts ahead of the 2025 deadline.