Every time there is a run up in prices on an asset, the common reaction is to describe the situation as a “bubble.”

The word bubble typically causes anxiety for sellers who are asking top dollar and consternation for buyers who are fearful of overpaying.

The universal reaction is usually to reevaluate the market regardless of the product type.

In residential real estate, the term bubble can work to slow down - or even halt - market appreciation.

In times of concern about potential bubbles, lenders typically pull back on financing due to fears that loan amounts could be greater than property values in the near future.

Some cliches that often pop up during bubble times include:

Don’t try to catch a falling knife;

Paralysis by analysis;

And get out while the getting is good.

Anyone doubting being on the wrong side of a bubble should consider the early 2000s experience. At the time, the U.S. residential real estate market appreciated rapidly - thanks in part of cheap financing - before depreciating just as fast during the Great Recession.

This boom-bust scenario played out in spectacular fashion for the condo market in South Florida.

Preconstruction units in Miami that were “sold” - contracts signed with nonrefundable deposits - originally for more than $600 per square foot but ultimately traded for one third of the original retail asking price in some cases.

This means new condo units sold for prices that were below replacement cost, despite Miami’s attractive weather, growing population and strategic geographical position in the Americas.

Fast forward to today where the bubble term is being thrown around to describe the current state of the Miami residential real estate market, which has experienced rapid price appreciation since 2019.

It is against this backdrop that the Switzerland-based investment bank UBS has named Miami as the riskiest real estate market for owner-occupied residences in the world.

To clarify that, Miami is the riskiest market of the 25 international-oriented cities - ranging from Sao Paulo to Toronto, New York to Hong Kong - analyzed for the 2024 UBS Global Real Estate Bubble Index report that was published in September.

To appreciate the ranking, it is important is understand how UBS defines a bubble.

“Price bubbles are a recurring phenomenon in property markets,” according to the report. “The term bubble refers to a substantial and sustained mispricing of an asset, the existence of which cannot be proved unless it bursts. But historical data reveals patterns of property market excesses.

“Typical signs included the coupling of prices from local incomes and rents and imbalances in the real economy, such as excessive lending and construction activity.”

The UBS report makes clear that its Global Real Estate Bubble Index report “does not predict whether and when a correction will set in” but rather identifies the areas that could be most vulnerable for price depreciation.

As for what causes a bubble to pop, the report states that it is often “a change in macroeconomic momentum, a shift in investor sentiment or a major supply increase.”

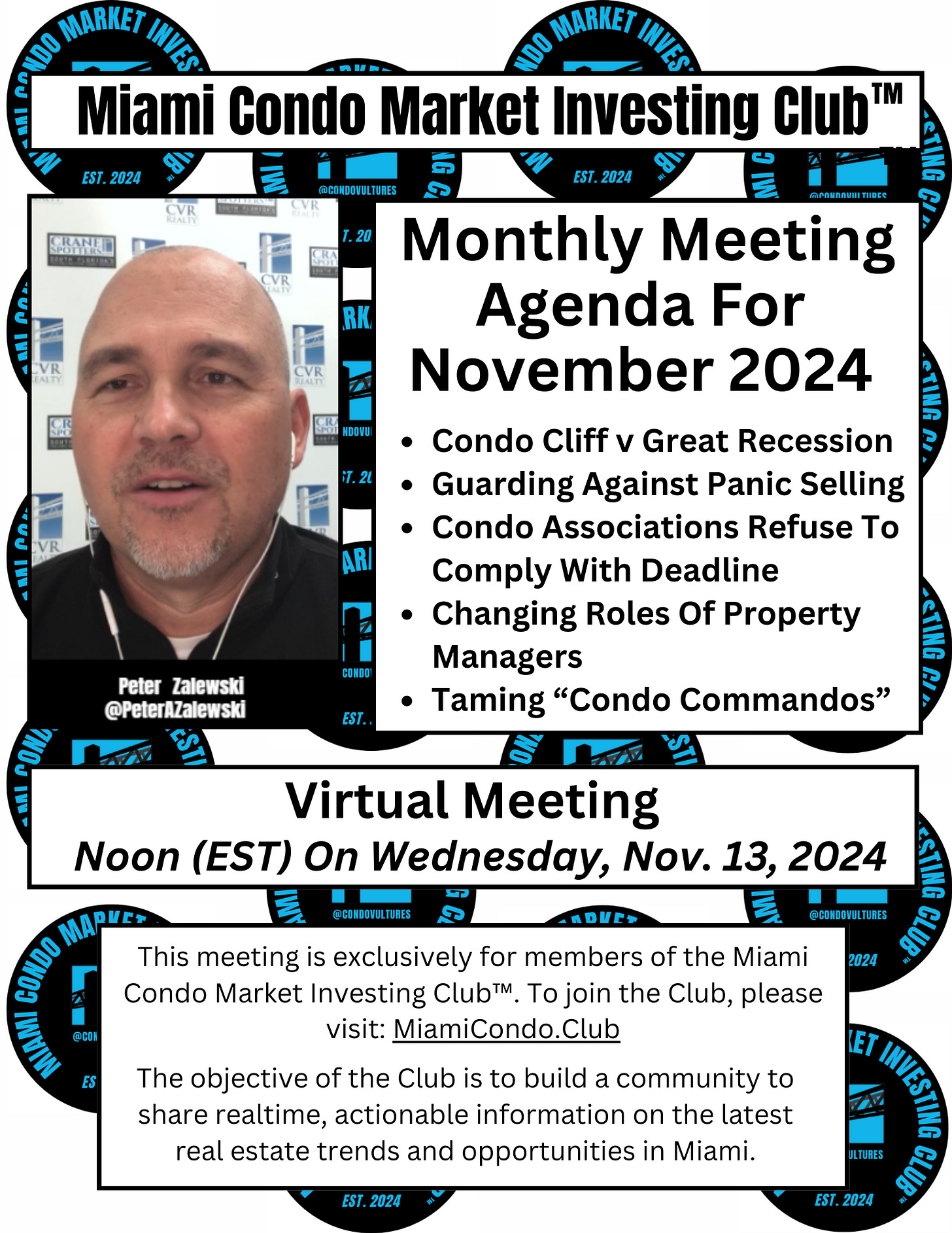

We crunch a lot of statistics each week and then publish the results byway of a series of reports posted on MiamiCondo.Club.

If you want the reports emailed to you, just sign up for the Miami Condo Market Intelligence Report With Peter Zalewski™ newsletter at: MiamiCondo.Club

Additionally, we encourage you to listen or view our podcast wherever you get podcasts. The podcast is available on Apple, Spotify and/or YouTube.

As a reminder, we are always available for consulting, expert witness work and buyside brokerage services just as we have been since 2006.

If you are seeking information on condo resales in South Florida, please visit CondoVulturesRealty.com or call the office at 305.865.5859.

This information is provided for general informational purposes only, based on research, personal experience and interviews. It should not be considered legal advice, as we are not attorneys. While believed to be accurate and complete, this information is provided "as is" without warranty or guarantee of any kind.

Copyright © 2024 Condo Vultures®, LLC. All Rights Reserved.